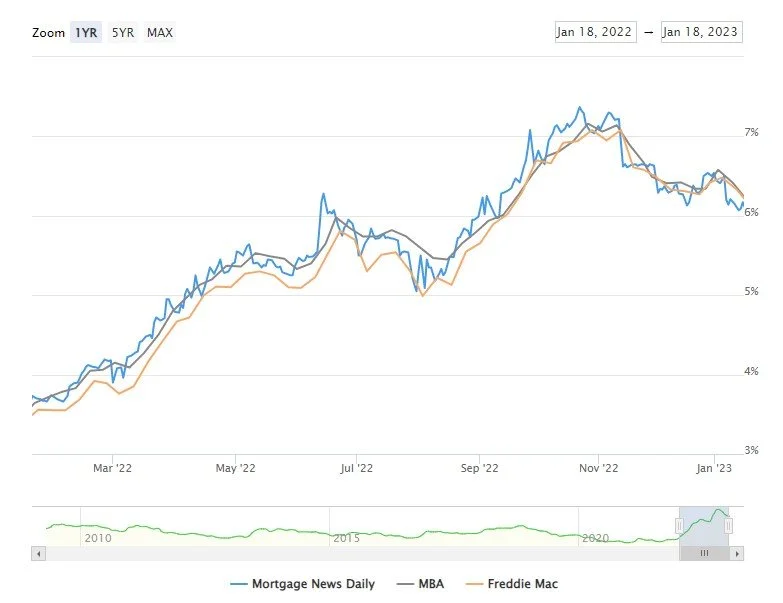

Mortgage Rates Fall to New 4-Month Lows After Downbeat Data

Mortgage rates moved down at a fairly quick pace today following a slew of rate-friendly headlines. Technically, the headlines were good for the bond market, but bonds are primarily responsible for determining day-to-day changes in mortgage rates. The first development arrived late last night when the Bank of Japan(BOJ) kept its monetary policy unchanged.

Markets expected the BOJ to make a tweak that likely would have put upward pressure on rates. When no such tweak was announced, bonds breathed a sigh of relief. In US trading, weak economic data added momentum to the bond market rally. A weaker economy coincides with lower rates, all other things being equal. Today’s centerpiece was a 1.1% decline in Retail Sales for the month of December as well as a negative revision that increased November’s slide from -0.6% to -1.0%. Other data also proved helpful, but most of the gains were intact after Retail Sales. When bonds make gains, mortgage lenders are able to offer lower rates. And that’s exactly what they did. The average lender moved down toward 6% with today’s rates being just a hair better than last Thursday’s. Then, as now, you’d have to go back more than 4 months to see anything lower.